payment plan for mississippi state taxes

Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. You can use this service to quickly and securely pay your Mississippi taxes.

File Ms Taxes With Dept Of Revenue E File Com

Sometimes lower or higher than the standard rate.

. How to Make a Credit Card Payment. There is an additional 1 tax in Jackson the state capital. Mississippis standard state sales tax rate is 7 but different items are taxed at different rates.

South view of the State Capitol in. For example manufacturing machinery sold. You will be taxed 3 on any earnings between 3000.

Thanks to a longstanding state tax provision Mississippians who are. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. Mississippis State Tax Payment Plan or Installment Agreement.

Tue090622-931AM 395 Reads 13404 Statewide. MSU offers two payment plan options. Each semesters fees will be divided.

By Molly Minta September 2 2022. The state sales tax rate in Mississippi is 7. Submit the installment agreement Form 71-661 with the.

File the return on or before the due date. If a taxpayer cannot pay off Mississippi state in one payment due to financial difficulties the MS DOR just like the IRS allows taxpayers to pay off tax. Mississippi is one of.

Mississippi Tax Payment Plan. There is an additional convenience fee to pay through the msgov portal. But Paycheck Protection Program loans are tax exempt.

Payment plan installment agreement electronic federal tax payment system eftps You need to have a clean record for the past 5. There are several options available when making a payment to your student account. If you make a non-qualified withdrawal however the earnings portion will be taxable to a resident recipient.

When a Mississippi taxpayer cannot pay off their taxes in certain cases a taxpayer can set up an installment agreement. Non-refundable enrollment fee of 7500 is due at the time the plan is established. Establish an account on the dtf website.

Mississippis State Tax Payment Plan or Installment Agreement. This includes withholding tax and. Can I get a payment plan.

This is the rate collected across the state with one exception. By MOLLY MINTA - MISSISSIPPI TODAY. Pay online using a creditdebit card or e-check see links below for.

The Mississippi Payroll Tax System PTS is a tax collection system that allows businesses to report pay and view all of their payroll taxes electronically. Mississippi plans to tax student debt relief. Where do I send my Mississippi state income tax return.

Pay by credit card or e-check.

![]()

Mississippi State Tax Payment Plan Details

Mississippi Is The First State To Confirm It Will Tax Forgiven Student Loan Debt With More Waiting In The Wings Business Insider Africa

Mississippi Requests 2b In Federal Covid Relief Funds Mississippi Today

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Master Of Taxation Mississippi State Online

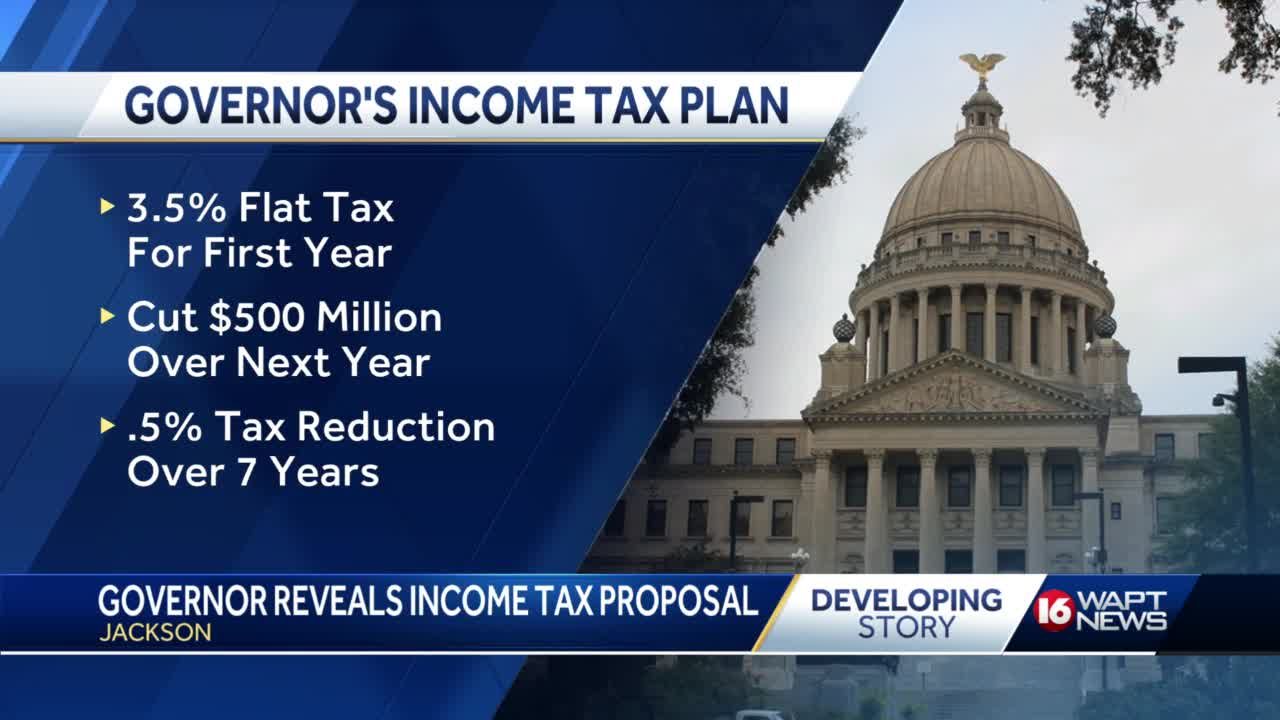

Gov Tate Reeves Reveals Income Tax Elimination Plan

Mississippi Tax Cut Plan Alive Then Dead Then Alive Again

Mississippi Income Tax Reform Details Evaluation Tax Foundation

Student Loan Borrowers In 7 States May Be Taxed On Their Debt Cancellation Npr

Ms Tax Freedom Act Of 2022 Mageenews Com

Mississippi House Of Representatives Pass Bills On Income Tax And Teacher Pay

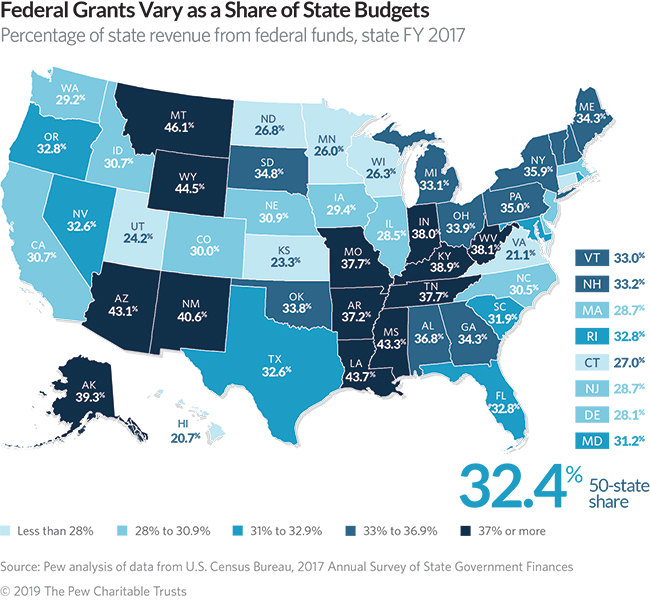

Mississippi No Longer The State Most Reliant On Federal Aid Mississippi Center For Public Policy

Mflex Mississippi Flexible Incentive Plan Mighty Mississippi

Mississippi Tax Rate H R Block

Mississippi Senate Advances 1 Tax Cut Plan Another Awaits Wreg Com

House Speaker Gunn Repeal Income Tax Before Allowing More American Rescue Plan Spending

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Mflex Mississippi Flexible Incentive Plan Mighty Mississippi